Does your BIGGEST investment have insurance cover? Is it protected well?

Home Insurance is probably one of the most ignored insurance covers in our society.

Home insurance penetration in India is just about 1%. Barely 3% of houses in India are insured. Countries like US, UK, France, Australia and China have home insurance penetration in the range of 90-97%.

“Home insurance accounts for only about 2% of the total premium collected by general insurance companies in India.”

Home Insurance cover is one of the broadest types of risk coverage one can buy.

There is no place like ‘Home,’ it’s our most valued possession and our heaven on earth. A House is one of the most expensive assets owned by an individual. We invest major portion of our savings to own a property but do not pay much attention to protect it from the risks arising out of natural or man-made disasters.

Natural Calamities like the recent Floods in Himachal Pradesh and a few other States in India bring the importance of Householders’ insurance policy back into focus. It is true that we may not stop natural disasters, but we can-definitely mitigate the losses and make provisions to cover the risks associated with them.

In this post let us understand – What is Home Insurance policy? What are the risks covered under a Householders’ policy? What are the factors to be considered when buying a home insurance cover? Which are the best home insurance plans in India?

What is Home Insurance Policy?

Home insurance policies are offered by general insurance companies (non-life) to cover your home against risks from natural calamities such as fire, floods, earthquakes, or landslides and also risks arising out of burglary/ theft, riots, strikes etc.,

The policy can have various sections that may broadly cover;

- The structure of the house alone (or)

- Your belongings such as jewellery, furniture, electronic appliances etc., (or)

- Even both.

Some home insurance policies are more comprehensive in extending coverage not only to your home, but also to the residents of the home against fire and other natural perils. These are known as package product that covers home along with providing an accident & third-party liability cover.

Some policies also cover your rent expenses if you have to move out to another house because your actual house has been damaged due to any of the covered perils listed by your insurer.

Who can buy Home Insurance Policy?

- Any Owner Occupant of a Flat / Apartment / Independent Building can purchase house insurance policy for his “Building and / or Contents, Jewellery & Valuables”.

- Any Tenant and other Non-Owners of Residential Structure can insure the “Contents, Jewellery & Valuables” in the Flat / Apartment /Independent Building occupied by them for residential purpose.

How is Home Insurance Premium calculated?

Your home insurance policy premium is calculated based on some of the below factors;

- Whether the property is owned and occupied by you or is it a let-out property?

- Whether the property is a Flat or an independent building?

- Age of the property

- Are you planning to take a cover for the contents or only the structure of the house or both?

- Place or location, size and type of construction of the house

- Do you want to include ‘Jewellary’ in the insurance cover?

- Additional covers like below are also offered along with the basic cover. You may have to pay extra premium to include these covers in the standard policy;

- Third-party liability (or) Public Liability cover

- Loss of rent or Alternate Accommodation

- Cost of shifting & Temporary Resettlement cover

- Pet Insurance

- Accident Cover

- Burglary cover

- You can also have a cover for portable equipment such as mobile phones, laptops, tablets etc.,

- Excess : An excess is the amount you must contribute towards a claim for each event that occurs. If you opt for ‘voluntary excess’ then insurance company will offer you discounted premiums.

- Worldwide cover for contents.

Home Insurance Policy & Sum Assured options

Most of the plans offer below Sum Assured options for Building Structure;

- Sum Assured On ‘Agreed Basis’ : This is mainly applicable for Flats/Apartments. The Sum Insured for Flat on Agreed Value Basis is arrived at by multiplying the ‘Total Sq Feet area of the Flat’ by the ‘value per square feet’. (Area of the flat is taken from the Sale Deed & Per Square feet value is based on Ready Reckoner issued by the Revenue department. In case If you wish to opt for an higher value than the one mentioned in the ready reckoner due to cost incurred on your part for any additional features added to the flat, you can submit ‘valuation report’ given by a Govt approved Valuer)

- Sum Assured on Reinstatement Value Basis : This is also known as ‘cost of re-construction basis’. Sum Assured is arrived at by multiplying ‘area of the flat/house’ by ‘cost of construction’ on present day basis. The cost of construction may not remain same every year, so some home insurance plans offer ‘escalation’ clause.

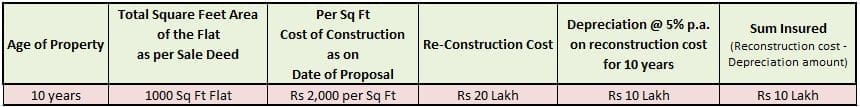

- Sum Assured on ‘Indemnity Value Basis’ : In this method, depreciation (natural wear & tear) value is deducted from the Reinstatement value (as calculated above). Indemnity value basis is commonly known as Market Value basis i

Most of the plans offer below Sum Assured options for Household Contents;

- New for Old Basis : The Sum insured for “Contents” shall represent the Replacement Value of the insured items by a new item of the same kind and same capacity. The natural wear and tear or depreciation is not taken into consideration.

- Indemnity Basis : The replacement value of the insured contents is calculated as ‘new item cost minus allowance for wear & tear or depreciation’.

- As far as Gold, jewellary, diamond & other valuables are concerned, the maximum sum assured limit and other terms & conditions vary from one plan to other plan.

Best Home Insurance Plans in India 2023-24

Effective from 1st April 2021, the Genral Insurance companies have to offer Bharat Griha Raksha Policy, a standard (basic) home insurance policy offering coverage against several allied perils. If you are looking for a comprehensive home protection plans, you may consider the below plans;

Below are some of the best and top home insurance plans in India for 2023 & beyond;

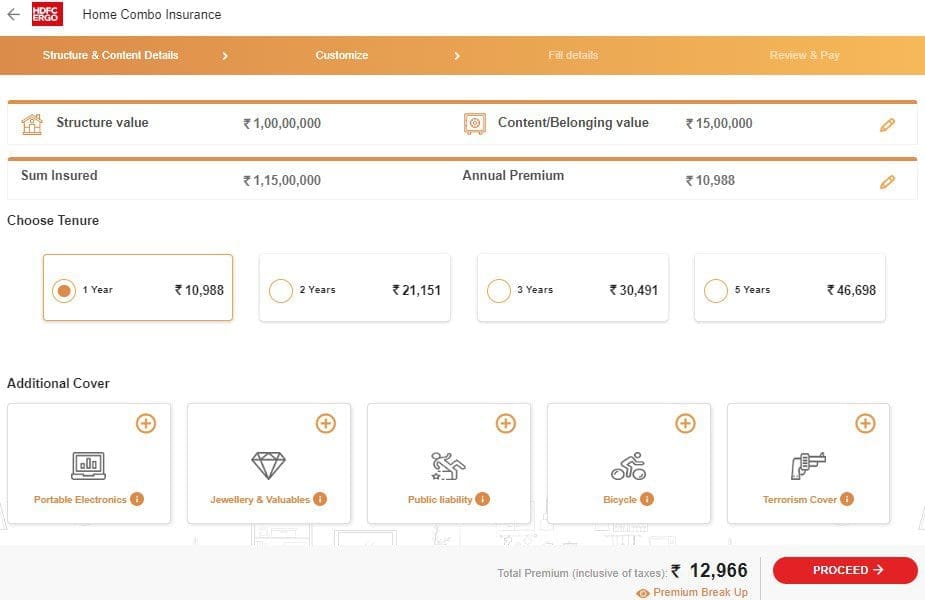

- HDFC Ergo Home Shield Plan

- ICICI Lombard Complete Home Protect Policy

- The New India Insurance Griha Suvidha Plan

- Digit Home Insurance Plan

- United India Home Holders Policy

(Click on the image to open it in a new browser window)

- I believe that New India Assurance’s Griha Suvidha and HDFC Ergo’s Home Shield plans are very comprehensive home insurance plans. By default these house insurance policies provide burglary, terrorism & jewelry insurance covers at a very competitive premium rate.

- HDFC Ergo do not offer the insurance cover if your home has been exposed to flooding in the last 5 years.

- Under HDFC Ergo’s plan, any household contents that’s over 10 years old are not covered under the insurance policy.

- ICICI Lombard’s home insurance plan is also a good one. But, we can’t generate premium quote online. They offer coverage for buildings which are as old as upto 50 years old.

- I have noticed that the coverage amount (threshold limit) for precious metals like Gold, diamonds etc., have been reduced across all plans.

- The portable electronic items like Mobiles, laptops, Cameras etc., are generally not covered under standard policy. You may have to pay extra premium (as an Add on cover) to get them insured.

- HDFC Ergo & Royal Sundaram plans provide Third party liability cover also.

- The Long-term Home insurance plan provided by SBI General covers only the building structure. The plan can be taken with a term of up to 30 years.

How to make a claim on your Home Insurance?

- After the calamity or unfortunate event, inform your insurance agent or insurance company about the destruction.

- You have to submit a written claim document to the insurance company within the period stipulated.

- The claim document should contain a detailed account of the articles lost/damaged and the actual value of each article.

- The insurer appoints a surveyor who will submit the final survey report (FSR) along with the documents submitted by you.

- On receipt of the documents, the claims department processes the claim.

- On approval of the claim, a letter is sent to you (insured) stating the approved amount of settlement along with the discharge voucher.

- In case of losses due to natural disasters, the insurance companies usually relax the claim settlement procedures that involve minimum documentation only.

What is the difference between Home Insurance & Home Loan Insurance (Mortgage Insurance) ?

You buy Home Insurance to cover the replacement cost of your home should it be damaged by fire or other accidents. Home insurance also covers the replacement cost of your belongings should they be damaged or stolen.

Home Loan Protection Plan, on the other hand, is simply to guard against the risk of default on home loan in the event of death of the borrower. The purpose of home insurance is to protect the homeowner. The purpose of mortgage insurance is to protect lenders (home loan providers).

Householders’ Insurance Policy : Important Points & FAQs

- Before buying a home insurance policy, it is advisable to download the ‘product brochure’ & ‘policy wordings’ document. Kindly know and understand the inclusions and exclusions on your House Insurance policy.

- As it is difficult to list out everything you own after it is lost, especially at the time of a crisis, it is important to prepare an inventory of your house-hold contents beforehand and keep it in a safe place. You may also scan the copies of costly / luxury items’ bills and save them online.

- It is beneficial to opt for a multi-year policy, which offers peace of mind along with with attractive discounts on Premium rates.

- Kindly note that the cost of construction keeps rising, so it may be wise to review your home insurance cover every few years. (Bajaj Allianz’s plan offers ‘escalation clause’ w.r.t. cost of construction)

- Royal Sundaram’s Gruh Suraksha plan has an option to opt for Escalation Benefit (10% of increase in Sum Insured each year) OR Tenure Discount (10% to 50%) for long term policies.

- Does home insurance cover cost of land? – No. Home insurance policy does not cover the cost of land. It only pays you for cost of re-construction of the house. If you are living in an Apartment, your residents’ welfare society can take a common cover for all the buildings of the society. Along with this common cover each flat can take householder policy for covering the contents of the house.

- If you are a tenant and planning to move out to another place then you can get your home insurance policy endorsed for change of address for household contents.

- In case if you are planning to sell your property, you (insured/owner) need to inform the insurance company and get the policy cancelled as you will not have an insurable interest in the property.

- What happens to the Home insurance policy if the insured house is sold? – From the time the transfer of ownership becomes effective, the policy stands cancelled and the insured ceases to be an insured under the policy. The Insurer may then refund the premium for the balance of the insured period.

- Can I claim Tax deductions or Tax rebate on home insurance premium? – No you cannot claim deduction under any Section on the premiums paid on home insurance.

- Does an home insurance policy cover Pets in the house? – A standard home insurance plan generally do not cover Pets. It can be available as an Add-on cover.

- Home Insurance plans are generally not provided for Under Construction Properties.

It is estimated that less than 1% of the people who can afford it have home insurance in India. Homeowners insurance can give you back a normal life in case your house or possessions are damaged or lost. I strongly believe that Property insurance is important and essential.

I hope you find this post informative. Do you have a home insurance policy? Kindly share your views and comments.

Continue reading :

- LIC New Plans List (2023) | Features, Snapshot & Review of all the Plans

- Why (NOT) to buy Return of Premium Term Life Insurance Plans?

- Life Insurance Money back Plan Return Calculation | Do-it-yourself guide!

(Post first published on 20-Jan-2016) (Post updated on : 07-Sep-2023)

Dear Sreekanth Reddy sir,

I sincerely thank you for this article, it is really informative.

However, I have a question and would be great if you can guide me.

Our co operative housing society has a insurance for structure of our building. My home loan bank which is SBI, sold me property insurance which covers structure [flat area] only as per policy document. Now my question is 1]can we have same structure insured from different vendors and 2] If yes how claim will be settled in case of calamity? Because I wouldn’t be in a position to submit original documents at both insurers.

thanking you in anticipation of a response to my questions.

regards

Hemant

Hello Sir.

Could you be able to tell me which is the best and cheap home /House insurance . want to insure my house foe 1.5 Cr (Construction cost plus furniture and interior) second is want to take a loan insurance coz I have 50 Lakhs loan on this , Please advice which is the best in these two issues

Dear Madhu,

You may consider ICICI Lombard or HDFC Ergo plans.

Hasn’t your banker asked you to take a mortgage insurance while sanctioning the home loan??

Hello Sir,

I need your advice to choose home insurace policy for my flat in appartment. My reqirement is to know few things.

Some key issues

1. like what will happen if

the appartment structure is partialy damage like cracks or fire, or tilted in one side gradualy. But insured flat is ok. Do I need addition cover for structure

2. Agreed Value Basis. Vs Reinstament which one to consider for sum insurred, if there is option.

3. As there some new plans 2022 please suggest which is better.

1. Griha Suvidha frm NIA

2. Irdai newly launched bharat griha raksa policy.

3. Bajaj Allianz Home Insurance they offer 3 home insurace policy.

A big thank you, for helping.

Thank you. Is it necessary to inform police after the theft etc, to get claim from insurance company or the company will inform police on insurers behalf?

Dear Dr Sudhakar,

Yes, need to inform the police, file an FIR at nearby/concerned police station and inform the insurer immediately..

Hi Sreekanth,

Thanks for such a valuable blog and information. We are buying a flat without going for the loan and initially paying 25%. The apartment is still under construction. Are you aware of any type of insurance policies for this apartment along with coverage for financial safety from the builder?

Thank you.

Dear Hema Chandra,

Are you referring to ‘Title insurance’??

If so, not many Insurers offer it’

Its available with HDFC Ergo ..

“Title insurance provides indemnity to property developers and homeowners against defects in land title that arise out of third-party challenges.”

Thank you sreekanth for the quick response. I quickly glanced through the details of title insurance and seems like it is for the developers and not the individual allottees. I was looking more for the benefit for the allottee (me) from the risks of any misdoings by the developer. This is generally taken care of by the banks if one goes for the loan but in my case as I am not going for a loan, looking for safeguarding the amount I am giving to the builder other than the agreement documents.

Dear Hema Chandra,

Owner’s title insurance: Owner’s title insurance is bought by the owner of the property to have protection against financial losses that may arise due to invalid property mortgage

I believe (unfortunately) that there is no such ‘insurance cover’ (at least in India) for mis-doings by the builders.

In such cases, the buyer can approach RERA.

Related articles:

*Checklist of Important Property Documents in India | Legal Checklist for Property Purchase

* How Home Buyers can file complaints against Real estate Builders online? | RERA Act

Hi Sreekanth,

Nice article. Need one clarification is Home insurance cover Roof Top Solar system.

And which is best in terms and condition of depression and damages due to lighting electric surge high speed wind damages PV panel or solar Inverter.

Dear Vivek,

Most of the home insurance plans in India do not specifically mention about the applicability of coverage for the roof top solar system. I believe that this needs to be added to the insurance plan after checking with the insurer..

Hi Sreekanth. Any reviews about the Tata AIG home insurance policy?

Dear Sunil,

I think their plans are decent enough, if they meet your requirement, you may go ahead..

When preparing the list, could not find the options to generate online premium quotes in their portal ..

Hi Sreekanth,

I am having 50 years old building. It was not built with cement. Currently, tenants are living at low rent Rs 5000/- month. They are complaining that roof wall pieces were falling some times.

1. Is Home insurance applicable to this type of building?

2. Is insurance company do any checkup’s?

3.If anything happens to tenants means, insurance company provide compensation to tenants ?

4. Currently, i cannot reconstruct / repair that building for atleast Rs 10L also. Any suggestion.

Awaiting for your reply.

Dear Praveen,

Home insurance policies are offered by general insurance companies (non-life) to cover your home against risks from natural calamities such as fire, floods, earthquakes, or landslides and also risks arising out of burglary/ theft, riots, strikes etc.,

Generally, under these plans, Home Structure and its contents are covered.

However, some home insurance policies are more comprehensive in extending coverage not only to your home, but also to the residents of the home against fire and other natural perils. These are known as package product that covers home along with providing an accident & third-party liability cover.

Some policies also cover your rent expenses if you have to move out to another house because your actual house has been damaged due to any of the covered perils listed by your insurer.

Suggest you to approach an insurer, they will check the property and provide you the premium quotation.

Hi, I am planning to purchase home insurance from Digit Insurance company.

They are really proving very attractive facilities but still, I want to know what things I should consider while purchasing home insurance from Digit. I have already taken car insurance from them and I got a quick claim from them when it was required.

Dear Sachin,

The important points that need to be considered while buying a home insurance plan (from any Insurer) are given in the above article, kindly go through them..

this is yearly premium, if i want to buy home insurance for 60 lac cover, only basic and for 18 year, single time premium which is cheapest

I read your article very nice but needs more comparitive information by including other 100% Loan Guarantee Lowest Interest Rate & Instant Approval Nationalized Banks.We are Profession All Kind Of LOAN providers For Home Loan,Housing Loan,Construction Loan,Mortgage Loan,TakeOver Loan, Loan Against Property (LAP),TopUp Loan,Site Purchase Loan,DTCP Approval,CMDA Site Loan,( And )an For Cibil Defaulters ( Loan Rejected )( Loan Problems )( Low Salary Profile )( Loan Denied )

Sir,

I and my wife have taken a home loan jointly from SBI for a property jointly owned by us. In home loan agreement form it was mentioned that “the property shall be insured comprehensively against the market price”. As I infer from it that the property insurance is mandatory, but it is not mandatory to buy it from the SBI General Insurance. When I checked my loan account few days back I found that a premium of Rs 12696/- has been deducted against the SBI Long term home policy for 10 yrs duration. When I wrote an RTI to SBI, I asked them to provide the criteria adopted to choose SBI General insurance company as preferred insurer. SBI declined it stating that it was “commercial confidence” shown by bank in the insurer, which is totally against the fair lending policy. Also when I obtained the proposal form (filled by SBI RACPC) of Long term home policy from SBI General customer care, there were many misinformation like it was shown that property is solely owned by wife, her DOB, loan amount (that is really strange), it was mentioned that it is independent house and situated on 2nd floor, while it is on 7th floor, area of property etc. Also it (i.e. the proposer SBI RACPC) allowed SBI General to share our personal data, I have written a mail to SBI General for correction of information. Request you to answer following queries

1. Due to the wrong information provided by the proposer (SBI RACPC), is there is a chance of claim refusal in future. Do you think that it was intentionally done by proposer?

2. By deducting premium of home insurance policy from loan account, loan amount is increased and we will have to pay interest on it. Does SBI have the authority to deduct from loan account without asking from us? What measures can we take?

3. Can I cancel the home insurance policy and take one on my own?

4. Can I complain to RBI regarding this and how?

Please provide your expert opinion. Thanks in advance.

Vivek

Dear Vivek ,

1 – Insured is the proposer for insurance. Yes, claim can be declined.

2 – Kindly check if the insurance is still in Free-look period? If yes, you may cancel it. Is this premium single-pay mode?

4 – You can complain it to IRDA.

Click here to visit IRDA Grievance Cell.

many thanks for prompt response. Free look period is not applicable in case of property insurance.

Dear Vivek..If that is the case, I have learnt a new point about home insurance today. Thank you!

Dear Mr Vivek, You can approach Consumer Redressal Forum for deficiency in service against both SBI & SBI General Insurance Company. While SBI is shameless & thick skinned, SBI General Insurance Company would compensate you even before you go to the Forum because what that Company did was fraud on you. You can reach me nskrish at gmail.

Not quite sure, if you are the same “Sreekanth” who replied to my query, when I posted this on other blog (basu Nivesh).

Query and the further discussion as per below. Bit long but worth reading

I wanted to buy a home insurance (basically structure insurance).

Went through many companies policies, called many of them. Most of them , don’t even oblige a callback request.

Anyways, the main issue is almost all POLICES states that ” On the happening of loss or damage to any of the property insured by this policy, the Company may:

1: Sell any such property or dispose of the same for an account of whom it may concern.

2. Keep Possession of the property.

The powers conferred by this condition shall be exercisable

by the Company at any time until notice in writing is given

by the insured that he makes no claim under the policy, or

if any claim is made, until such claim is finally determined

or withdrawn, and the Company shall not by any act done

in the exercise or purported exercise of its powers

hereunder, incur any liability to the Insured or diminish its

rights to rely upon any of the conditions of this policy in

answer to any claim.

The Surprising part is “SELL ANY SUCH PROPERTY” When I enquired about this clause from the companies, NONE of them ( and I mean 3-4 big companies) were able to answer this part.

No one is willing to even call me:)…haha….Imagine a situation wherein you want to buy something at the price set by the seller but no one is selling that to you. Something is wrong..seems

Just an observation to share with you. Maybe you could investigate it further.

Almost all companies have this clause in an home insurance policy.

Sreekanth says

September 10, 2016 at 10:24 PM

If you are seeing a particular clause in all policies then it obviously means incidental but not coincidental! No banker will just come to a property and sell it off just like that. That clause is common in most countries. Usually when a property was damaged beyond control and once the insurance amount is paid off then the bank may at their will sell it off. This is like giving a device to service center or manufacturer during warranty. The manufacturer will do what they want. If you don’t want this then don’t claim insurance/warranty. If the problem is minor just like how the service center gets the device repaired the company pays off the money as per the T&C. If it is beyond repair then they ‘may’ sell it off. This is exactly what the clause says – “The powers conferred by this condition shall be exercisable

by the Company at any time until notice in writing is given

by the insured that he makes no claim under the policy, or

if any claim is made, until such claim is finally determined

or withdrawn, and the Company shall not by any act done

in the exercise or purported exercise of its powers

hereunder, incur any liability to the Insured or diminish its

rights to rely upon any of the conditions of this policy in

answer to any claim.”

Besides, an insurance policy is subject to solicitation. Solicit=To ask. No insurance policy should be provided by an insurer as per IRDA unless the insurer asks for it. You not getting a call back is NOT because there is anything fishy in it rather they are NOT interested due to low commissions. But if you go to a branch no branch will reject you from opting it. In fact, that’s what should be done. An agent coming at doorstep is only a convenience not a rule. But it is the customer who should “solicit” an insurance policy.

ravi kant says

September 12, 2016 at 11:38 AM

Thanks a bunch “Sreekanth”. Loved your prompt response. Once again , thanks dear for your time and effort. Much appreciated.

My response in red, please.

If you are seeing a particular clause in all policies then it obviously means incidental but not coincidental! No banker will just come to a property and sell it off just like that. That clause is common in most countries. Usually when a property was damaged beyond control and once the insurance amount is paid off then the bank may at their will sell it off. This is like giving a device to service center or manufacturer during warranty. The manufacturer will do what they want. If you don’t want this then don’t claim insurance/warranty. If the problem is minor just like how the service center gets the device repaired the company pays off the money as per the T&C. If it is beyond repair then they ‘may’ sell it off. This is exactly what the clause says powers conferred by this condition shall be exercisable –

The issue is the term “PROEPRTY”. Let me explain how. As you rightly said, “Usually when a property was damaged beyond control and once the insurance amount is paid off then the bank may at their will sell it off.”

The problem here is:

1: A property is not a like mobile device (Home is more closer to heart than even WIFE?) wherein the cost of the device is the “Total cost”. In case of a property, it is “the building” + “THE LAND”. As you know, “the land” has more value than the structure itself. Hence, when a property was damaged beyond control (Insurance company will pay me only the structural damage amount) and then as you said “bank may at their will sell it off.”

So, if my property worth 50 lakh (20 lakh building cost +30 lakh land cost). My insured amount is only 20 lakh (as you know, companies covers only structure cost and not land cost). If there is a damage (beyond repair) and If , I ask for the claim, then I would only get 20 lakh.

Pretty surprised , whether, I am buying an insurance to safeguard myself or am I buying some C graded, equity mutual fund (risk is greater than return).

2: The very Term “damaged beyond control/correction”. Is again an problem. For a building, at least, it can be rebuilt always unlike mobile device?. Hence, though, I agree with you but still, if you ask me, there is nothing beyond damage control”.

None of us can help, as this is what policy says.

Besides, an insurance policy is subject to solicitation. Solicit=To ask. No insurance policy should be provided by an insurer as per IRDA unless the insurer asks for it. You not getting a call back is NOT because there is anything fishy in it rather they are NOT interested due to low commissions. You are dead right. The point was, few companies, who have replied to me, have NOT been able to explain this part clearly. I should say this is “FEARFUL”

But if you go to a branch no branch will reject you from opting it. (I fear more now to buy the policy. Reason , is the example, which I cited above. Loss is more than gain). In fact, that’s what should be done. An agent coming at doorstep is only a convenience not a rule. But it is the customer who should “solicit” an insurance policy.

Sreekanth says

September 12, 2016 at 4:32 PM

The clause clearly says “On the happening of loss or damage to any of the property insured by this policy, the Company may”. May=uncertain. So, where is the question of unilateral decision that could be taken by company as you claimed? No where the clause gives indication there will be a unilateral decision. This is same as a health insurance policy which states “The company may defer part of the payment or reject the claim in case if all the requested documents provided are not furnished”. Does it mean, the insurer is going to reject the health insurance claim ALL the times?! Such clauses which you see are written by Insurance Actuaries to safeguard the companies so that there are no undefined gaps while settling the claim. You can always talk to higher department if you think the lower department are unable to answer you and provide them the feedback that the clause can be worded in more detail. I’m sure you have/had never heard/read anywhere where a banker took control of a property which is insured even during Jharkand floods!

avi kant says

September 12, 2016 at 4:48 PM

Thank you .

It is not about the decision but the very fact that, if something major happens (For this reason only one buy the policy and not for minor damages) then, asking for the claim will invoke this clause and ultimately one would be in TOTAL LOSS.

I tried to mail everyone, I could but unfortnately no reply from anyone to explain this clearly.

You are right, no one has never heard/read anywhere where a banker took control of a property . But the point is, by virtue of this clause, if mutually agreed then an insurance company can take it. Hence the fear. (My point is no benefit of buying the policy for major loss (so-called damage beyond repair)

Totally in sync with you ” You can give feedback to the company that the clause can be worded in more detail”. I wish they reply. Months have passed with myself sending infinite E-mail for no good.

Real property: what’s covered, and what’s not

Basic (and premium) home insurance policies provide coverage for you home, aka ‘dwelling,’ and other structure on your property, but not your land. Because, you can insure your home on a leased land, even a flat in a multistorey building, the Insurer can collect all the rubble by invoking the “dreaded” clause.

Hello Sreekanth, I was wondering if you could help me understand how NIA’s Griha Suvidha is different from the other available home insurance products? GS talks about pre-fixed premiums and sum insured on a first loss basis, which is unlike the other policies. Appreciate if you could elaborate on these points.

– Anirban

Dear Anirban,

I believe that the features are almost same as other HI Plans.

Insurance on a “first-loss” basis means that the policyholder and the insurance company agree on a maximum sum insured per loss event for a certain module of an insurance.

It is like a type of partial insurance (which covers less than the full value of goods or property at risk) where both the insured and the insurer acknowledge that the ‘subject to average’ (see average) rule does not apply. These policies cover only the estimated largest possible loss, and are used commonly in the burglary or theft insurance where the possibility of total loss is extremely remote (such as in case of a large store).

Nice article friend

thing where A common man should be educated like difference bet home loan insurance and

home insurance ,and claim awareness

like considering the insurer positive approach to the product

Thank you dear Nagendra. Keep visiting 🙂

Dear Srikanth,

Very good article on non life insurance plan. I really appreciate the efforts taken by you in bringing out all related information under non life insurance plan which is self explanatory. Thanks a lot.

With regards,

C.P.Reddy.

Dear Mr Reddy..Thank you for your appreciation 🙂

Sreekanth this is another valuable information provided by you, it not only enriches our understanding of Non life insurance but also guides us to the right policy

Dear Uday..Thank you and keep visiting 🙂