ASSOCHAM (The Associated Chambers of Commerce of India) in association with CRISIL (Credit Rating Information Services of India Ltd) has recently released a research report on Indian Insurance Industry. This report has some very interesting facts and figures about Insurance sector (covers both Life & Non-Life insurance industries) in India.

CRISIL’s knowledge report gives insights on wide array of topics like – Life and General insurances penetration in India, Insurance density in India, growth of insurance industry, statistics on Insurance Agency network, issues & challenges in insurance selling, Govt’s initiatives to promote insurance industry, technological initiatives & strategies etc.,

The Indian Insurance Industry (sector) was opened up to private participation with the enactment of the Insurance Regulatory and Development Authority Act, 1999.

Post liberalization, the number of participants in the insurance industry has gone up from six insurers (including Life Insurance Corporation of India, four public sector general insurers and General Insurance Corporation of India as the National Reinsurer) in the year 2000 to 52 insurers currently operating in the life, non-life and reinsurance segments in India.

Below are some of the key points from CRISIL’s report.

CRISIL’s Report on Indian Insurance Industry

Insurance Penetration & Density in India

India’s insurance industry has come a long way since the reforms of the 1990’s. As of Sep 2015, 52 insurance companies were operating in the country, including 24 in life and 28 in non-life segments.

Though the number of insurance companies operating in India has increased significantly, hundreds of millions of people have limited awareness and/or access to insurance and financial services. India as a country still remains grossly ‘under-insured‘ in terms of insurance penetration and density.

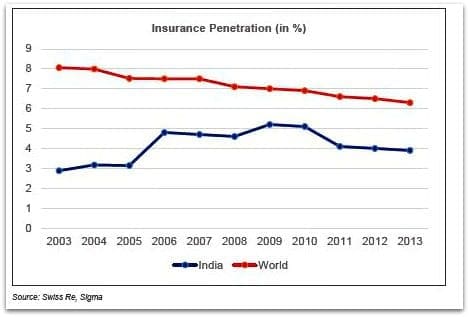

- Insurance penetration (measured as a percentage of insurance premium to GDP) rose from 2.71% in 2001 to 5.20% in 2009.

- It has then declined to 3.9% in 2013-14, indicating the growth in insurance premium is lower than the growth in national GDP.

- India’s insurance penetration is far below the world average of 6.3%, largely due to limited financial awareness and literacy among the masses.

- Further, while India stands at 3.1% in terms of life insurance penetration versus a global average of 3.5%, it lags far behind in non-life insurance where the penetration is a mere 0.8% compared to the world average of 2.8%.

- India is also far behind advanced economies in terms of insurance density (which is measured as a ratio of premium to total population). The annual insurance premium per capita (density) is abysmally low at $52 or less than 1% of annual income compared with 7% and 12% in the US and UK, respectively. Life Insurance density is at $41 and Non-life insurance’s density in India is at $11 only.

- Life Insurance penetration is very low in most of the North-Eastern states, Chattisgarh, Haryana and Delhi.

- Lack of Agency penetration is also observed in most of the districts in North-Eastern states.

(The report does not talk about quantum of sum assured or the average sum assured per life insurance policy. I believe that this is also an important factor in terms of insurance penetration.)

Indian Non-Life Insurance Industry

- The report indicates that awareness and popularity of general insurance requirements is increasing in India.

- The country’s non-life insurance sector (in terms of gross domestic premium income) has grown at an annualized rate of 16% from Rs 17,481 crore in 2004-05 to Rs 77,525 crore in 2013-14, compared with a 7% growth in the economy.

- The share of India’s non-life insurance premium to total insurance industry premium increased to 20.9% in 2014 from 17.8% a decade ago.

- Though as an industry non-life segment is growing at a rapid phase, India’s share of the global non-life industry is a mere 0.7% only. But, growth in terms of premium is higher than that of advanced and emerging countries.

- Motor insurance is mandatory in India. Due to this reason, the motor insurance dominates the Non-life segment in India. India’s non-life insurance industry is dominated by motor insurance (43%), followed by health insurance at 25%.

- The report points out that awareness levels about Health Insurance is on the rise in India. Health Insurance segment in India has been growing at 25.5% CAGR. It is estimated that the total premium has increased from Rs 3,999 cr in 2006-07 to Rs 19,677 cr in 2013-14.

- The growth in non-life insurance premium collections is an encouraging factor, but this growth is not uniform across the nation. As per the Insurance Regulatory and Development Authority of India (IRDA report 2013-14), four states – Maharashtra, Tamilnadu, Karnataka, and Delhi UT – accounted for 62% of the total health insurance premium, whereas the other 32 other states/UTs (union territories) accounted for just 38%. Of these, again, the eight states in the north-east contributed a meager 0.6%. This shows that the distribution and growth of health insurance segment has been very skewed.

Insurance Intermediaries

Below table gives us an idea about how new business premium income has been sourced from (ie through which channel of distribution the new business has been coming from.)

The above figures clearly indicate that individual agents’ market share (life insurance) has declined in the past five years, while there has been a surge in the popularity of the direct channel / online aggregators. But at the individual level, the majority of the life insurance policies are sold through individual Insurance Agents followed by banks.

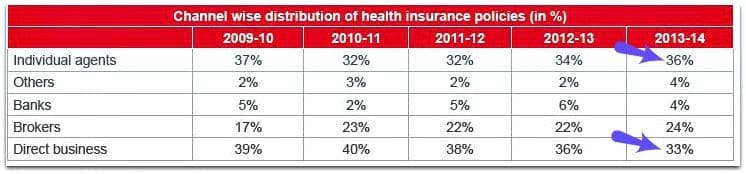

The below table gives us an idea about the channel wise distribution of health insurance policies in India. The ‘direct channel’s’ market share has been on a decline whereas individual agents’ market share has remained more or less stable.

Mis-selling practices

In India, Life insurance is primarily sold as a tax-saving instrument rather than as a risk coverage product. There is a considerable amount of misinformation about insurance in the mind of the average Indian investor and hence a crying need to change people’s perception and outlook on insurance.

The report indicates that the mis-selling is highly prevalent in India. This is leading to high no of complaints against mis-selling practices. It also says that the complaint resolution rate has increased drastically. The complaint resolution rate in life insurance increased from 86.41% in 2009-10 to 99.69% in 2013-14 and in the non-life segment from 79.63% in 2009-10 to 98.71% in 2013-14.

Recent regulations in insurance industry points to heavy penalization for mis-selling and mis-representation.

Govt’s initiatives

The financial literacy in India is very low. Access to financial services especially in rural areas of India is also limited. But, recent Govt initiatives have proved that low-cost banking or insurance products with a clear purpose and aggressive marketing program could bring more people in to the financial system. The success of Jan Dhan Scheme or Pradhan Mantri Jeevan Jyoti Bima Yojana or Pradhan Mantri Surasksha Bima Yojana are examples for this.

Also, the FDI (Foreign Direct Investment) limit in insurance sector has been increased from 26% to 49%. The insurance business requires huge capital and higher FDI cap will benefit the sector. Higher FDI limit could help in deepening the insurance penetration in India.

CRISIL estimates that the current govt’s financial inclusion agenda, along with technological initiatives and increase in intermediaries, can potentially grow the insurance industry over 2.5 times in the next five years.

(Image courtesy of fantasista at FreeDigitalPhotos.net) (Reference & Source : ASSOCHAM-CRISIL’s report on Indian Insurance Industry Oct 2015.)

I think insurance companies and NBFC’s that provide insurance can also contribute their share by spreading awareness through their CSR activities.

Agree with you dear Ajish.

All the PSU’s have CSR activities, the exposure for such things in print media or any other form of media is very less.